SEBI- Class VIII certified investment advisor.

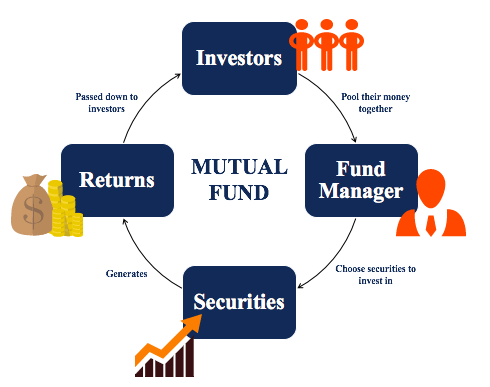

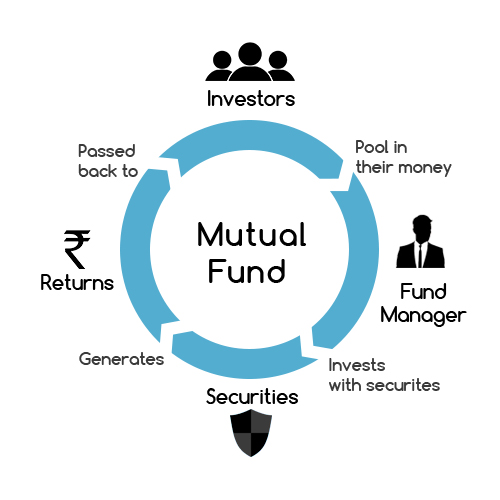

Mutual Funds

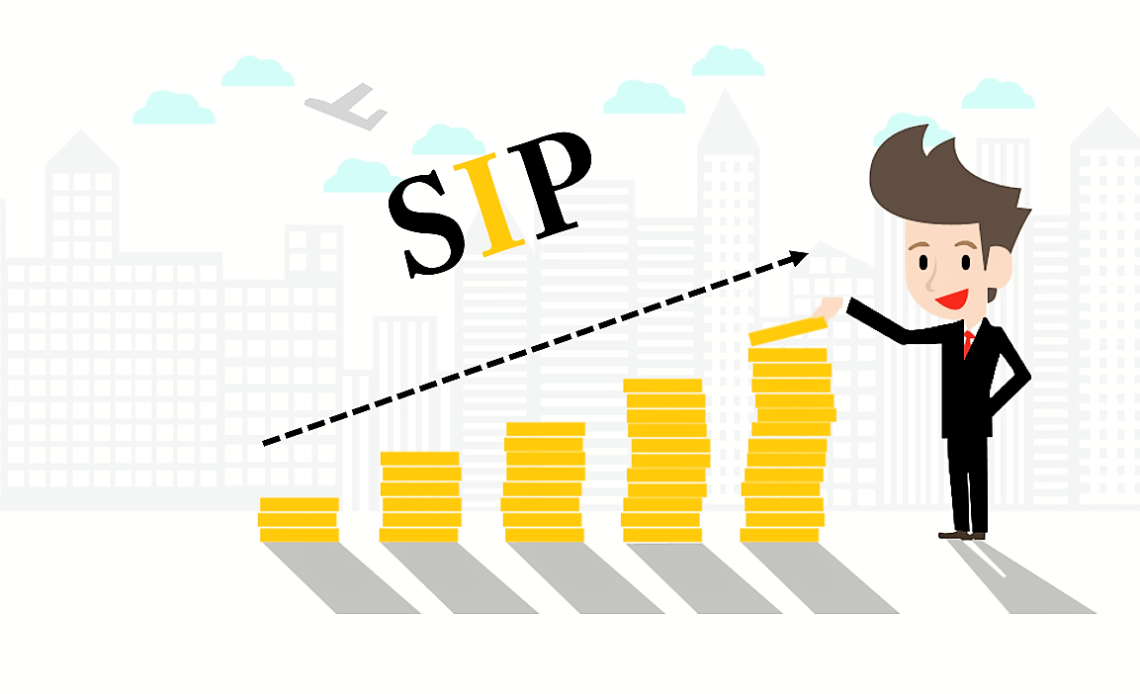

We are guiding to invest in Mutual fund. With over 6 years of experience, we are giving best possibilities in mutual fund. Few major companies are listed below.

- SBI Mutual Fund.

- ICICI Prudential Mutual Fund.

- HDFC Mutual Fund.

- DSP BlackRock Mutual Fund.

- Aditya Birla Sun Life Mutual Fund.

- Kotak Mutual Fund.

- L&T Mutual Fund.

- Tata Mutual Fund.